Blockchain vs. cryptocurrency, or blockchain vs. bitcoins in general, are two of the most confusing buzzwords in use today. Some people see them the same way, while others paint a different picture yet still come to the same conclusion. In any case, it occurred as a result of technological advancements.

While both terms are popular, they are very different. When we think about blockchain, we think of the years 2016–18, when companies were seeking to improve their entire organizational efficiency. So, blockchain is an emerging technology. In contrast, cryptocurrency is a type of digital asset represented by digital coins, the usability and benefits of which are still being developed.

Simply put, Blockchain is not limited to cryptocurrencies. It’s much more than crypto.

What are Blockchain and cryptocurrency?

All right, let’s start with blockchains. To put it simply, the blockchain is a digital ledger that can be used to record any type of transaction or data. A separate piece of data or information is stored in each block of the chain. These interlocking blocks function much like a centralized digital ledger in that they contain the entire chain. All information is arranged in a time-based order.

After the global financial crisis of 2008, there was an outcry for a new kind of money that could not be wiped out by the incompetence of banking institutions. After so many people lost everything due to banking failures, the globe turned against banking firms. Earlier this year, Bitcoin began revealing promise as the next reliable, bank-resistant (!) currency.

Crypto is another story

It’s a whole new ballgame when it comes to cryptocurrency. It’s the cryptocurrency of the blockchain, or the asset, that powers the network. “Tokens” is a common term for this in the industry. But there are also blockchains whose ecology doesn’t rely on tokens. Tokens aren’t required because this blockchain doesn’t use them.

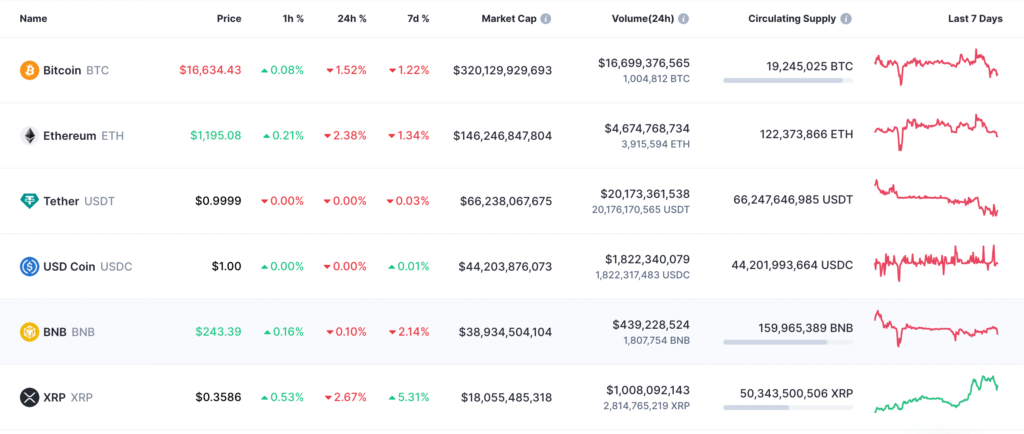

Today, there are almost 21,844 cryptocurrencies in the world. The most common cryptocurrencies are Bitcoin, Ethereum (ETH), Tether (USDT), BNB, and much more.

Unlike cryptocurrency, which is powered by blockchain technology, blockchain technology does not rely on any particular cryptocurrency.

You can think of blockchains as the United States central bank and cryptocurrency as the currency used to buy things there. The token-less blockchains we’ve seen demonstrate that there are also blockless cryptocurrencies. In this regard, IOTA serves as a great case study of a successful distributed ledger corporation.

Crypto and blockchain: A constant struggle for attention

what’s going on? Is this a way to “redo” after the FTX mishap? A return to basics? Is there a third factor at play here?

Unfortunately, crypto users have a history of misfortunes. Approximately 75% of investors have lost money in the cryptocurrency market. As soon as cryptocurrency advertising boosted global trust, new challenges emerged.

FTX, a cryptocurrency trading platform, experienced bankruptcy on November 11, 2022, which further shook the confidence of cryptocurrency investors. Since crypto and blockchain are still often used interchangeably by the general public, this is another reason why the latter has lost credibility despite being based on an entirely separate concept.

This is understandable in light of the devastation wrought by excessive leverage, weak token economics, fraudulent trading practices, and high-profile reminders that cryptocurrency is about more than simply greed are welcomed.

Has blockchain fulfilled its promise to satisfy business interests?

The challenges

If you believe the buzz, the latest round of blockchain excitement hasn’t led to any tangible benefits. In pilot projects and proofs of concept, tests with lettuce, plastic, and even (scary) nuclear warheads didn’t seem to lead to anything useful. Many of the groups working on ways to use blockchain in trade finance, healthcare, telecommunications, insurance, and other fields seem to have given up or stopped doing business.

Unfortunately, there have been numerous high-profile distributed ledger failures recently.

- IBM and Maersk have officially declared the end of their blockchain-based supply chain joint venture TradeLens.

- After years of delays and cost overruns, the Australian Stock Exchange (ASX) decided to scrap its much-touted blockchain project.

- When B3i, a blockchain insurance effort supported by more than 20 insurers and reinsurers, shut down, it followed the dissolution of we.trade, a blockchain-based trade financing initiative funded by IBM and 12 major European banks.

The Hype

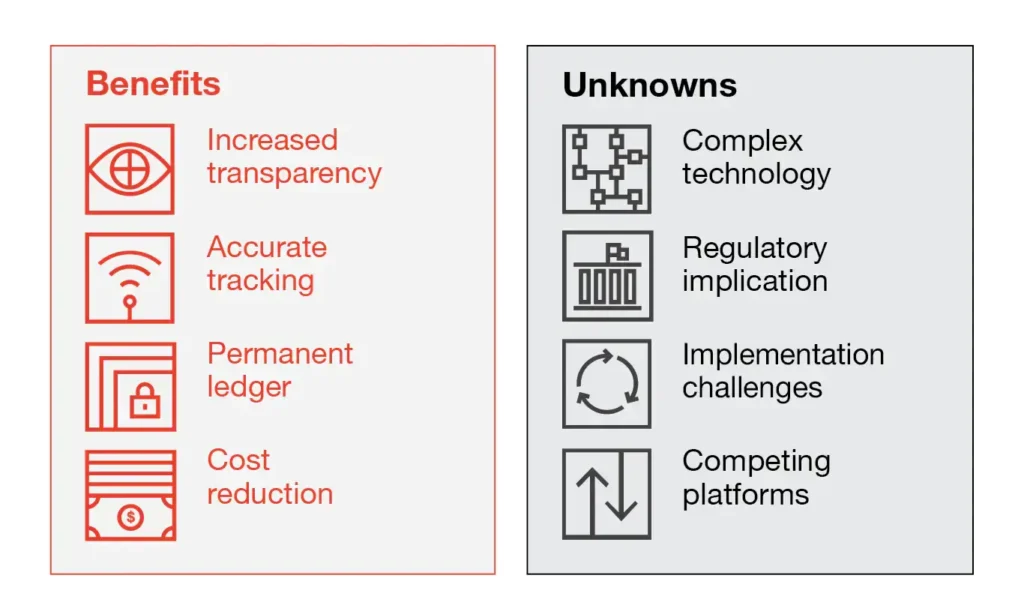

Despite numerous failures over the past few years, the blockchain industry is promoting the following advantages of the technology.

Cost Savings

Enterprises can save money thanks to blockchain’s efficiency gains.

Speed

Blockchain technology expedites the flow of both money and data.

Smart contracts

Many companies in the Chicago area employ blockchain technology so that their online contracts, known as “smart contracts” or “digital contracts,” may be executed automatically.

Verification

Blockchain-based technologies enable the confirmation of business-to-business and business-to-customer transactions regarding financial transactions.

Blocks are designed to make it difficult, but not impossible, for users to make changes to the data contained within them, making them a secure way to store, track, and trade assets and information.

Innovation

Since blockchain technology is mostly unregulated, entrepreneurs can try out new business models without worrying about getting in trouble with the law.

Perhaps these advantages are real, but to what degree? The blockchain industry has publicly admitted that its major initiatives have largely failed.

92% of Blockchain Projects Have Died; Their Median Survival Rate Is 1.22 Years

So this is blockchain marketing, then? If blockchain is faced with greater challenges, why use covert marketing ways?

The Hope

The less dramatic aspects of blockchain development could benefit from some spotlighting, though. Because people are humans and creativity should always surprise us, we may yet encounter some ideas that seem absurd, and who knows, they may even take root. On the other hand, we can anticipate more serious experimenting at the highest levels.

Crypto world: may or may not be strange

It’s odd to hear crypto supporters claim that only one strategy is worth any time and effort, given that the crypto ecosystem is now large enough for a variety of ways and that this business was built on the basis of permissionless creation.

Anyone interested in distributed ledger practicality has many reasons to be optimistic. Markets will continue to change, and some prices will eventually rise again, which will please those who think that trading and saving are more important in society. We should consider how our industry would change if one smaller group were given the authority to choose what is “legitimate” and what isn’t, despite the fact that many of us may be frustrated by the number of images given to what we individually view as meaningless ideas.

It’s up to you to decide if you can stomach an investment paradigm where the price of a single bitcoin might range from $7,000 one minute to $2,000 the next. Right now, greed is more of a driving force than any sort of idealistic corporate concept. The reality of the crypto world, though, is that this is how things work.

Final thought

The change in tone will also be a welcome reminder that there is more going on in this sector than quarterly earnings and decisions about investment strategies, and that the industry’s potential goes far beyond a better mood, clearer rules, and a better understanding of the problems at hand. There is sufficient space for both “blockchain and crypto” or “blockchain vs. cryptocurrency” to flourish.

Leave a Comment